Getting to the Final Closing Table

The final step in funding your loan or "closing" on your purchase is where all final documents are signed, last minute underwriting conditions are met, and money is exchanged.

At this point in the mortgage process, all inspections and appraisals have been completed, initial contracts and documens have been reviewed through underwriting, and it is time to sign your final documents.

What to Be Prepared for at Closing

A closing is where the borrower sits down with a notary, escrow agent, or attorney to complete the transaction.

Schedule Your Appointment

You'll need to be ready to take enough time to sign all of your loan closing documents and have your questions answered.

Try to leave a few hours open after your closing appointment to prepare for delays so that you aren't rushing through the important process of reading and understanding what you are signing.

Funds to Close

If it is required for you to bring in the down payment and/or pay for closing costs to finalize the transaction, you’ll need to bring a certified check from a bank. The escrow company, your agent, and loan officer should provide you with a full breakdown of all fees and costs involved in the transaction.

If you don’t have to bring in any funds to close, then you might actually be getting a portion of the earnest money deposit back.

Keep in mind, it is important to make sure these funds to close come from the proper sources.

Updated Documentation

If you have not already provided your lender with updated paystubs or bank info, they may ask that you bring it to closing and have any other final documentation sent back with the final signed loan documents.

Proof of Identification

Official driver’s license or state-issued ID card.

Mortgage Closing FAQ's

Providing proper asset documentation and the actual source of the funds is a critical element of the loan closing process.

There’s nothing worse in a real estate purchase than making it all the way through the hoops and hurdles just to have a loan denied after the final documents have been signed due to the borrower using the wrong checking account for the down payment.

Seasoning of the down payment money (length of time you've had the money) is just as important as the source, which is why underwriters typically require at least two months of bank/asset statements in the initial mortgage approval process.

A few acceptable sources of down payment include:

- Bank Accounts – checking/savings

- Investment Accounts – money market, mutual funds

- Retirement Funds – Keep in mind that borrowing against a 401K plan will require a repayment, which will be calculated in the debt-to-income ratio.

- Life Insurance – Cash value and face amount

- Gifts – Family members can gift down payment funds with certain restrictions

- Inheritance / Trust Funds

- Government Grants – Many state, county, and city agencies offer special down payment assistance programs.

It is extremely important to make sure your loan officer is aware of the exact source of your down payment as early in the process as possible, so that all necessary questions, documentation, and explanations can be reviewed/approved by an underwriter.

A good rule of thumb to remember is that whatever funds you’re using as a down payment have to be pre-approved by an underwriter at the beginning of the mortgage approval process.

The earnest money deposit is credited towards the buyer’s closing costs and/or down payment.

Any additional funds are given back to the buyer from the escrow company.

No. New credit accounts affect your credit score and should never be pursued prior to the closing and funding of your loan

All borrowers and co-borrowers need to be present at closing to sign the legal documents. If they can not be there at the same time, arrangements can be made for separate signing appointments. You may also choose to have your real estate agent or lender available to help answer any questions.

It could take an hour or longer to review and sign all closing documents. Be prepared for minor delays in scheduling conflicts.

Two forms of identification and certified funds for your cash to close

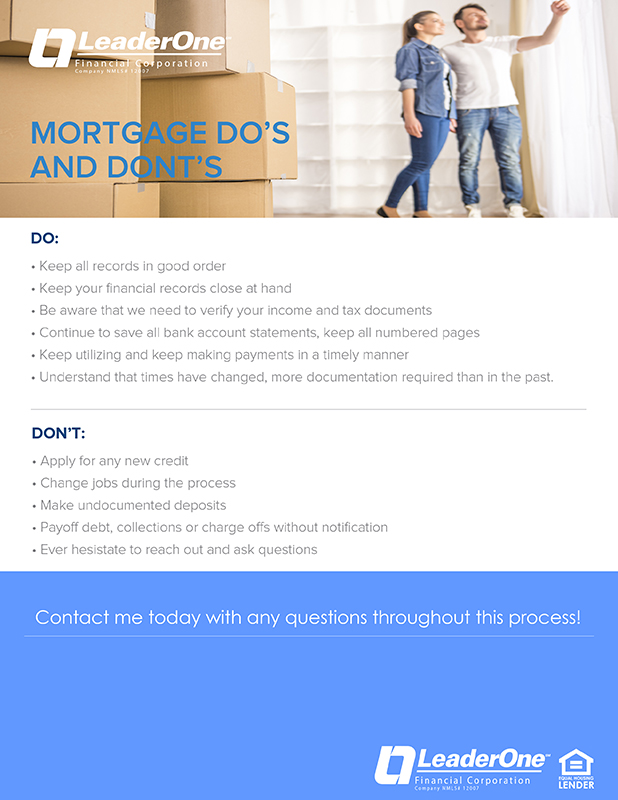

Stay calm and keep communication lines open. All parties are invested in getting you into your new home. Be patient and honor any additional document requests from underwriting as quickly as possible.

Click To Download

Click To Download